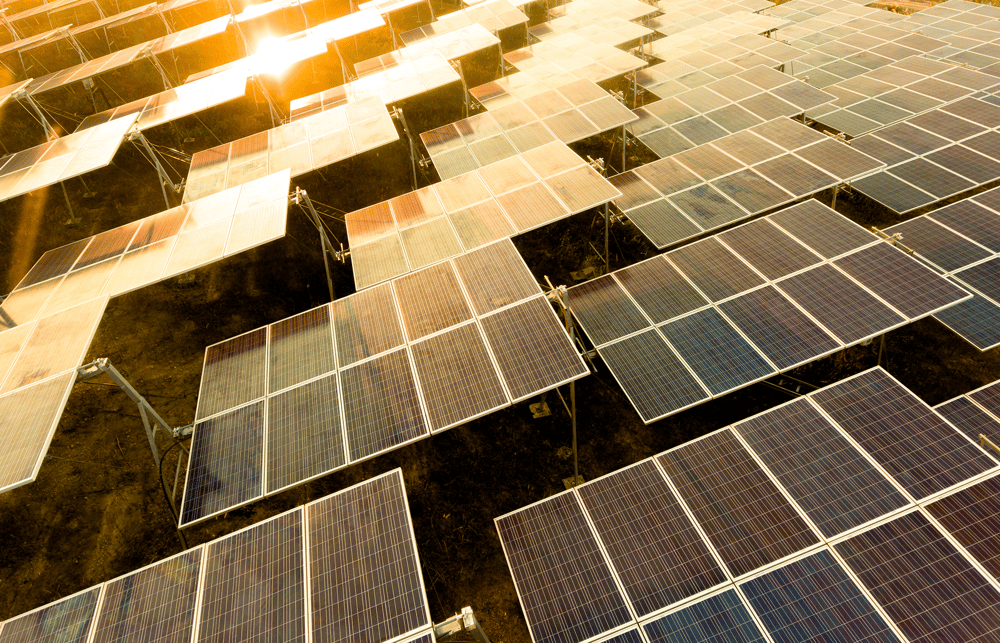

There’s no doubt about it: disruption is in the air for Belgium’s energy market. When it comes to utilities, our country is facing numerous challenges in different areas, including technological, topological, regulatory and sociological changes. At the same time, we have been struggling with persistent paradoxes for quite some time now. Consider, for example, the almost exponential growth of alternative energy sources, while Europe is confronted with energy overcapacity. The debate concerning a nuclear power phase-out, too, is far from over, and our idea to rely more on gas-fired power stations is in no way consistent with the increasing pressure Belgium is under to drastically reduce its CO2 emissions.

Although we are eager to change course, the energy transition in Belgium is proving much more difficult than in other countries. The reason? There are at least four obstacles holding us back.

We live from election to election

A successful energy transition requires political ambition combined with a straightforward plan. A common vision, in other words. Getting everyone on the same page, however, is not evident in a country that shuns long-term commitments and lives from election period to election period.

A rise in awareness and permanent, active involvement of public opinion are more necessary than ever. Regulators must assume an entrepreneurial role, adopting a more visionary and strategic approach. The energy market must, of course, also ask itself whether it will continue to watch from the sidelines, or actively start to enforce the new regulations themselves instead. Perhaps it’s our entrepreneurs who should be molding Belgium’s political landscape and thus establish a definitive framework for our future energy supply, which will then be constantly evaluated and adjusted?

In any case, exceptions within the current legislative framework are crucial to create innovative trajectories that will allow the energy market to experiment with new, more future-oriented business models So, why wait any longer to let innovation work its magic?

The customer is not yet king

The growing focus on sustainability and affordability means that every player will have to do their bit to meet the needs of the rapidly changing energy market. In the near future, customers will pay for a certain comfort level and no longer per amount of energy used. And by ‘comfort’, we mean more than just an adequate supply of gas and electricity. Heat, cable distribution, maintenance services, etc. will all be part of the offer. The customers’ choice for more or less comfort will determine the price they pay.

Producers, suppliers and new market players will therefore have to take on a significantly more important role than before. New durable energy sources must be integrated into a personalized offer for customers, just as raising awareness among prosumers (consumer that is also a producer of energy) with the help of the digital meter will become a must.

If today's energy players want to survive in tomorrow’s landscape, they must evolve into full-fledged partners for their end customers and provide them with the comfort level of their choice in a personalized manner. Being able to redeem that customer expectation in the near future will undoubtedly require an enormous effort, because every player will have to expand their offer and adjust their operational activities accordingly.

We have a lot of catching up to do

Belgium faces numerous challenges in the area of energy transition in the coming years. Compared to our neighboring countries, we have fallen behind considerably and urgently need to catch up to remain competitive. Important decisions must be made as soon as possible – a difficult exercise which will unfortunately require more than five minutes of political courage.

However, what our country lacks most is leadership. The entire energy sector is fully engaged in a digital transformation in which the integration of existing and new infrastructures, as well as new forms of organization and partnerships, take precedence. Technological innovation will provide the necessary support in this regard – utilities, after all, meet technology through innovation! Individual organizations will have to work in an ecosystem of partners looking for solutions and new models together.

Cost reduction too often remains a priority

The question remains which role grid managers will (or should) play in this energy transition. Belgium is currently experiencing a consolidation wave initiated by regional distribution system operators whose main objective is to save costs. Further cross-border integrations are likely to be the next step. The gap between electricity and gas on the transmission side continues to grow as we speak, raising many questions. What will the role of gas in the future energy landscape be exactly, and will it be able to solve our current electricity problems? How can we use the gas network to make other forms of energy feasible? As long as the big players remain in it for the money, all these questions will be left unanswered for quite some time at least.

Fingers crossed for energy transition à la Elia

Undoubtedly, the energy players who are daring enough to take on a pioneering role by actively responding to the challenges mentioned above will turn out the most successful in the long term. The energy market is clearly in need of brave leadership beyond that of the technical experts and network operators who have been dominating the sector so far. It will take true entrepreneurs to smoothly guide organizations through the chaos and pave the way for a whole new kind of energy landscape.

The further decentralization of electricity generation already provides a strong innovative drive in the market, with Elia as the initiator. Their "Internet of Energy" ecosystem is already supported by both traditional and new market players. But as benefits innovation, it’s not always immediately clear how certain efforts are valued. Elia, too, will have to wait and see what the future brings, but nevertheless the market’s enthusiasm about their initiative is promising, to say the least.