For a very long time, most organizations in banking and insurance were convinced to have quite a good view on which client segments they were serving or wanted to target and developed products and services they considered these segments needed or longed for. Focus was on creating good products and delivering good services in the most efficient way at the lowest cost and with the largest distribution possible. Overall clients satisfied themselves with products and services “close enough to their needs” as long as security , trust and quality was ensured.

Why personalization?

Security and trust still remain the top requirements when it comes to banking service, so does quality. Multiple studies and reports though demonstrates new customer values: financial services need to be frictionless (convenient), personalized (relevant) and omnichannel (consistent and time/place independent).

The evolution in client expectations and behavior, the increased need for innovation and engagement are accelerated mainly by forces outside of our sector and are irreversible. Consumers want to be treated ‘special’ in every business relationship and no longer accept to be pinned based on their age, income, … Bye bye one-directional, automated push communication and one size fits all interactions and offerings. Consumers are increasingly adept in cracking the façade and recognizing mass, automated messaging.

How to deliver?

Financial services providers deem to be well positioned, since they sit on a vast amount of internal data which, if structured and efficiently accessible, they can combine with external, open data to achieve new levels of insight, with a greater contextuality and timeliness than ever possiblejust a few short years ago. Predictive analytics, artificial intelligence (AI) and machine learning can be combined to provide a hyper-relevant capability that is delivered in real-time using digital devices.

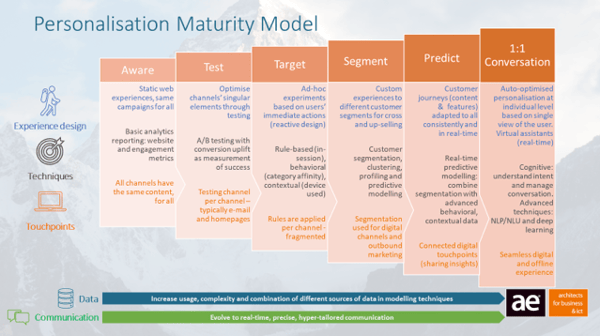

AE’s business architects have developed a maturity model which is used to assess our banking and insurance clients’ maturity in personalization. Our model distinguishes 6 levels of maturity assessed by looking at 3 domains: experience design, techniques and touchpoints. We help our banking and insurance customers to determine in which of the 6 levels their organization is situated

6 levels : Aware – Test – Target – Segment – Predict – Full personalized 1-on-1 conversation

Starting from the organization’s current or target reference architectural model and the assessment of the current maturity level of your organization, we determine together the actions and roadmap to move on to the next level. Every level comes with a step up in usage, complexity and modelling of data on the one hand and an evolution in real-time, precise and tailored communication on the other hand.

Our maturity assessment and service delivery comes with the typical AE mindset, pragmatic with focus on value creation, product / supplier independent and with a co-creative spirit and benefits from the broad expertise of our multidisciplinary team of solution & business architects, information modelers, data scientists, innovation and service design experts, …

In the coming weeks, we’ll share our concrete approach and the different disciplines AE involves in making the banking experience of your clients more relevant. Just watch out for our posts on social media!

Do not hesitate to contact us via inspire@ae.be for a deep-dive conversation!